Your Real Estate Update 10/14/2020

All in one page are your county’s housing trends at a glance. Indicators provided are sales, median prices, inventory indicators, and so much more!

What is Your Home Worth?

Click HERE to Check current market values for your home and view profiles of potential buyers.

Neighborhood News

Click HERE to stay connected to what’s happening in the real estate market in your area.

The Cost of a Home Is Far More Important than the Price

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported:

“Newly pending sales are up 25.5% compared to the same week last year, the highest year-over-year increase in the weekly Zillow database.”

Whenever there is a shortage in supply of an item that’s in high demand, the price of that item increases. That’s exactly what’s happening in the real estate market right now. CoreLogic’s latest Home Price Index reports that values have increased by 5.5% over the last year.

This is great news if you’re planning to sell your house; on the other hand, as either a first-time or repeat buyer, this may instead seem like troubling news. However, purchasers should realize that the price of a house is not as important as the cost. Let’s break it down.

There are several factors that influence the cost of a home. The two major ones are the price of the home and the interest rate at which a buyer can borrow the funds necessary to purchase the home.

Last week, Freddie Mac announced that the average interest rate for a 30-year fixed-rate mortgage was 2.87%. At this time last year, the rate was 3.73%. Let’s use an example to see how that difference impacts the true cost of a home.

Assume you purchased a home last year and took out a $250,000 mortgage. As mentioned above, home values have increased by 5.5% over the last year. To buy that same home this year, you would need to take out a mortgage of $263,750.

How will your monthly mortgage payment change based on today’s lower mortgage rate?

This table calculates the difference in your monthly payment:

That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

Bottom Line

Even though home values have appreciated, it’s a great time to buy a home because mortgage rates are at historic lows.

Your March Market Update

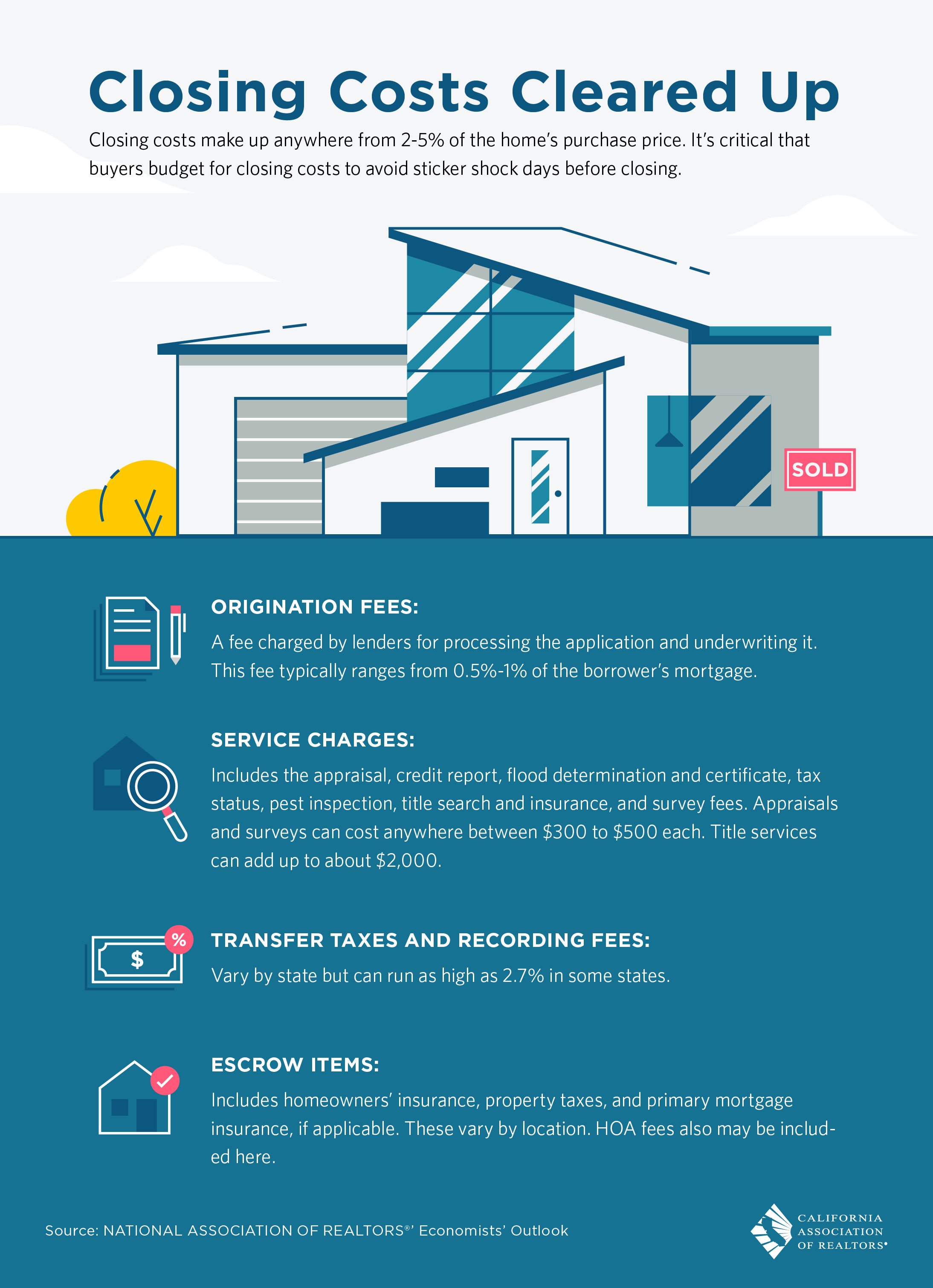

Closing Costs Cleared Up

You’ve made an offer — you’re almost there.

In your excitement don’t forget closing costs. Set funds aside to cover these before signing!!

Need more information? Call me anytime to discuss.

Weekend Plans?

Sip fine wines, enjoy live bands, take your fur baby out to socialize, street party under the stars while enjoying Filipino talent, get your foodie on with local vendors, celebrate October Fest with steins of beer at the pier, or take the family out for $1 deals at the races! Whatever you decide, have a fun and safe weekend everyone!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Reasons to Fall in Love with Homeownership [INFOGRAPHIC]](https://virginiaacio.com/files/2020/02/Unknown.png)

![Reasons to Fall in Love with Homeownership [INFOGRAPHIC]](http://virginiaacio.com/files/2020/02/Unknown.png)